How We Work

We provide discipline, transparency and planning to help you achieve your long-term goals.

Are we what you are looking for?

There are all sorts of individuals and firms offering to help you with your financial life. Sorting out what they actually do can be extremely challenging. That’s not an accident. Some people intentionally mask their real agenda because if you knew it, you’d never hire them.

We are going to do the opposite; we’re giving you a clear picture of how we serve clients. We believe that this is the only way to build long-term client relationships. We hope you like what you read, knowing that if you do, you’re likely to hire us – and more importantly, remain happy with our relationship.

What do you need to know about us?

Some people incorrectly assume that we just handle investments. The finest investment process is of no value if the amount you have invested is inadequate to achieve your goals. We help you determine if the amount you are investing will actually match up with your desired spending level in retirement. Ultimately, our role comes down to helping our clients know the truth of their financial situation and then help them frame their decisions in a way that gives them their best shot at achieving their ultimate goals. We’re here to do what our tagline says:

Helping busy people make smart financial decisions.

We really plan.* As a result, our clients have a good idea where they stand and where they’re headed. We’ve prepared and updated hundreds of plans over the past thirty years. We use some of the most sophisticated planning software available. Our fee structure keeps us accountable to do the planning. Some firms “say” they plan, but are paid the same whether they actually do or don’t. Other firms don’t even make an attempt to plan, they just manage money.

Our planning is aimed at helping clients achieve overall, long-term financial success. We work with the big picture of your wealth, rather than just its individual parts. We examine your investment options, relevant tax strategies, cash flow implications, estate planning issues, risk management approaches and available fringe benefits to help you get where you want to go. Simply put, we want to make sure that you are on track to actually reach your goals.

We receive no commissions or any third-party compensation. This allows us to reduce or eliminate conflicts of interest and align ourselves only with you and your best interests.

We don’t take custody of your funds. We utilize independent custodians, such as Fidelity and Schwab, so that you can independently verify the value of your funds at all times. We believe our fee structure is unique within our profession because of our objective to keep it affordable and fair whether you are of modest means or have accumulated sizeable wealth..

Who do we typically serve?

The largest occupational group we serve is physicians. Our typical client has a life that is busy, complex, and leaves little time to actively manage important financial matters. We professionally manage our clients’ day-to-day financial lives, so they can focus on the big decisions they face.

Our client relationships involve a high degree of financial intimacy. Just as a physician must have a complete and accurate history and physical on a patient before providing medical care, we must have a clear understanding of our client’s facts, goals, values and concerns. We depend on a complete, accurate and open information flow with clients.

Our happiest clients are smart decision makers who can openly share important facts, beliefs and goals; balance current consumption with building for a sound future; and recognize that in an uncertain financial world there are no easy, quick and certain solutions. Our clients generally share three characteristics:

- Collaborative Delegator – Our clients prefer to use what little spare time they have doing something they enjoy rather than researching investment options or reading tax code. From a governance standpoint, we collaborate with you on the formulation and selection of your portfolio allocation, and you oversee our work as you receive reports from both us and independent third parties. We rely on you to keep us up-to-date as changes occur in your life. You are the C.E.O. of your financial affairs and we are your executive staff. Our relationship is open, collegial, and intimate in a professional manner.

- Disciplined Spender – We focus on providing clients with extreme clarity about spending patterns and the way these impact their long-term financial status. Short-term impulses can absolutely destroy long-term aspirations. Few of us are disciplined spenders by nature. We help you move in that direction by utilizing cash flow strategies to help you shape your spending patterns. This helps you modify your own behavior, to lead you toward your financial goals.

- Realistic Investor – Finding a sound, rational process for keeping your funds invested can be challenging. Markets operate in random cycles and can be difficult to predict. Our clients come to understand the realistic relationship between risk and return. They realize that blogs, articles and advertisements often encourage speculation, rather than investment. They recognize that “buy low, sell high” consistently outperforms behavior driven by emotional reactivity. Most importantly, they understand that it is the process and not transactions that ultimately matters.

If you can see yourself growing to embrace these three characteristics, you will likely be happy with what we can do for you. We have positioned ourselves to have extensive knowledge about our clients and try to be available to serve them through whatever “curveballs” life may present. This limits our availability for project work. We don’t accept engagements to provide a “second opinion” on portfolios or manage a portion of your investment portfolio, or prepare a plan that you will implement on your own.

If your goal is to grow your wealth with consistent, reliable financial assistance, we are happy to help. We accept engagements to provide holistic financial advice and then work with you to ensure prompt implementation, using the most appropriate and cost-efficient methods.

How do we invest your money?

There is a science to investing that is superior to seat-of-the-pants, anecdotal speculation. Our process is based on the work of two Nobel Laureates and other noted thought leaders. We pay particular attention to downside risk and volatility. It is a process that is rigorously applied and consistently followed.

We start by developing a Risk Profile for each client that blends Risk Tolerance (your willingness to accept loss) with Risk Capacity (your ability to accept loss, based on your facts and circumstances). We use Optimization software to help us develop a customized portfolio allocation based on your Risk Profile. We use a combination of Mutual Funds, Exchange Traded Funds (ETFs), and Bonds to implement your allocation. Our investment committee meets quarterly to evaluate the investments being used in client portfolios.

Finally, we develop an Investment Policy Statement that guides our ongoing actions on your behalf. We want to minimize the surprises you might experience with your portfolio. We believe that the only way you will achieve your goals is by selecting a rational, disciplined course of action and then sticking with it.

How much does this cost?

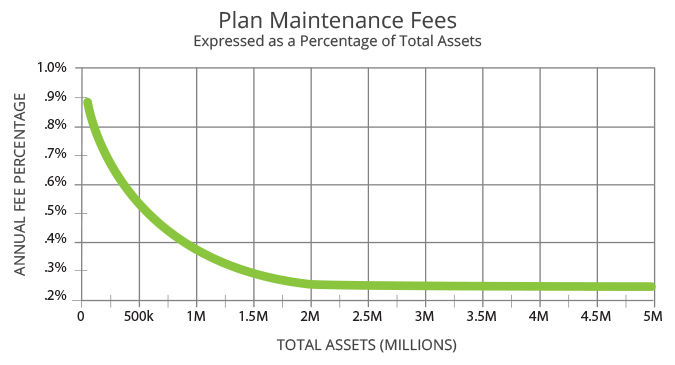

Most financial planning firms around the country use a “bundled” approach that bases your fee on some percentage of your portfolio size. The customary percentage firms charge is 1% per year; some charge even more. To provide perspective, a 1% fee translates into an annual fee of $10,000 on $1 million portfolio.

In our view, this structure creates problems for two types of clients: those just starting out and those with substantial assets. Doctors just getting started often have high income potential but few assets. At a time when they really need planning advice, most firms won’t talk to them because they impose a minimum asset level before accepting an engagement.

Many of our substantial clients today started with virtually nothing, but with years of planning and saving they have progressed impressively toward their goals. Alternatively, many clients come to us with portfolios in excess of $5 million. They have great difficulty justifying an annual fee of $50,000, $100,000 or $150,000 (and honestly, so do we).

To keep our fees fair, we have separated our fee for analysis, document review and consultations from the maintenance of the investment process. This fee structure keeps us accountable to you so that your financial game plan is actually prepared and that it remains up-to-date, even in the face of life’s many curve balls. Our fees remain fair and affordable as your portfolio grows over the years. We know you don’t want to receive a bill every time we send you a letter, take your phone call, prepare a financial statement or run an analysis. We handle these issues using a reasonable quarterly Core Financial Planning Fee. Prior to hiring us, you receive a written estimate that describes both your initial deposit and your quarterly Planning Fee. We review your Core Financial Planning Fee regularly against your actual utilization to make sure it remains fair to both you and us.

The second portion of our fee structure allows us to maintain your game plan as it has been established or modified. We select the investments that are consistent with your allocation and rigorously monitor your portfolio allocation, rebalancing as necessary. We report to you on a quarterly basis so you know how your portfolio is doing. We refer to the portion of our services that maintain your game plan as the Investment Management Fee. As shown in the graph above, we are able to provide these services so that your fee percentage decreases as the size of your investment portfolio increases.

Visit Careers to find your next job at Arkansas Financial.

Please Note: The scope of any financial planning and consulting services to be provided depends upon the terms of the engagement, and the specific requests and needs of the client. The Arkansas Financial Group does not serve as an attorney, accountant, or insurance agent. The Arkansas Financial Group does not prepare estate planning or any other type legal documents or tax returns, nor does it sell insurance products.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.