Why Does the Market Keep Rising?

The most frequent question I continue to receive relates to the puzzling heights of the Stock Market. On Wednesday of this week, the S&P 500 was within six points of the high this year. Since the market hit bottom on March 23, the S&P 500 is up 50.40%. Who’d have thunk it! The natural impulse at the time was to “Sell, Sell, Sell!”

The decline in March was due to COVID fears and the oil battle being waged between the Russians and Saudis. Yet there has actually been positive correlation since March 23 between COVID statistics and the stock market. Negative correlation had been expected – as COVID increased, the markets were expected to decrease. Back in early March, I started a new hobby – tracking the COVID statistics for World, U.S. and Arkansas trends.

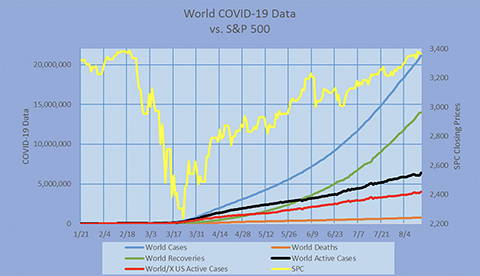

Here’s one of the charts that resulted from that tracking:

The y-axis on the left is for the COVID Data; the y-axis on the right is the S&P 500. By February 19, the market had risen 4.81%, a high for the year. Over the next 4½ weeks, the market plummeted 33.92%. While the drop was bad, the rapidity made it even more distressing.

Why did it drop?

Most people assumed that it was COVID. Technically, it was fear over what COVID might cause. On the day the market hit bottom on March 23, how many deaths due to COVID would you guess we had we experienced in Arkansas? If you guessed anything but zero, you were wrong.

The first two COVID deaths in Arkansas were reported the next day on March 24. On that day there had been 18,614 deaths worldwide, 696 deaths in the U.S. and 2 deaths in Arkansas.

Yesterday those same numbers were 753,283, 167,097 and 582, respectively. Therefore, with 40 times as many deaths in the world; 240 times as many deaths in the U.S. and 291 times as many deaths in Arkansas, the stock market goes up 50.40%! As Vizzini kept saying in “The Princess Bride,” INCONCEIVABLE!

The answer to the question “Why did it drop?” is simply a) fear and b) panic. There was also a pervasive expectation that there would be a high negative correlation between COVID cases and deaths increasing and the market falling.

Three Reasons for the Rise

Why has the market risen so much since March 23 considering the continuing growth of COVID cases and deaths? There are three reasons:

- The Fed flooded the financial system with cash around March 18 to stabilize cash and bond markets, as both were suffering from lack of liquidity. This didn’t get a lot of ink at the time, but immediately these markets stabilized and six days later the stock markets started their recovery.

- The various stimulus packages put cash in the hands of American families and the PPP provision allowed companies to avoid massive lay-offs of employees. The principal reason the Great Depression extended for almost a decade was the fact that no one had any money to spend. That just killed the economy. The stimulus checks gave American families cash to spend, and many did. PPP gave small businesses, particularly non-profits and churches (who don’t participate in the unemployment System) the funds (and therefore the ability) to keep paying their staff. This is far more efficient in the long run since you don’t have the scrambled mess of laying off and rehiring. The current stalemate in Washington puts this in peril.

- Because of technology, creativity and ingenuity, not all businesses have suffered in this new COVID environment. In spite of many high-profile bankruptcies in the retail sector, others in that same sector are booming. Amazon and Wal-Mart have had record quarters. A similar pattern has developed in air flight. Passenger carriers have been decimated; FedEx and other bulk carriers are busier than ever. Some restaurants have creatively found ways to survive. Others will never return.

Clearly, because of our “hard headedness” in the United States, COVID’s impact is going to extend at least another three to four months or however long development of a viable vaccine will take. A terribly divisive Presidential Election won’t help matters. The impact of children going back to school is a total wild card. Yet, I wouldn’t over-obsess with any of these single factors. None of them “control” financial markets. Don’t try to “out-guess” the markets. You’ll be wrong more than you’re right.

Live Your Joyful Life

The economy is much larger and driven by many more factors than the one factor an article you might read over the next few months would have you to believe is so important. This is why the articles we’ve been sending are important to your well-being. Living a joyful life can be wrecked by obsessing overly negative articles, blogs and posts designed to create fear – in order to get you to do, buy or believe whatever that author is selling.

The next eighty-one days (or eighty-eight if we have the election results in a week) are going to be stressful and uncertain. I encourage you to find ways to bring positive thoughts and actions into your life. Find ways to serve others. Find ways to be an emotional support to others. Spend time with those you love. Listen to beautiful music. Re-read classic books you may have read as a young person. Watch The Princess Bride!

If we can be of help, don’t hesitate to call.

Rick Adkins, CFP®, ChFC, MBA

© 2020 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. (“AFG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AFG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of AFG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a AFG client, please remember to contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. AFG shall continue to rely on the accuracy of information that you have provided.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.