When Will They Learn?

I’m beginning to think that stock traders can only see six feet (or six hours) away and react like lemmings. They seem to have no vision beyond the most recent news. They currently have an obsession with the Federal Reserve Discount Rate. And like a gaggle of kindergarteners, they freak out or go happy crazy, depending on whether their desired short-term outcome happens or not. At the moment, their “desired short-term outcome” is for the Federal Reserve to lower rates. That’s not going to happen as long as inflation continues at present levels. Yet things aren’t as bad as you might think.

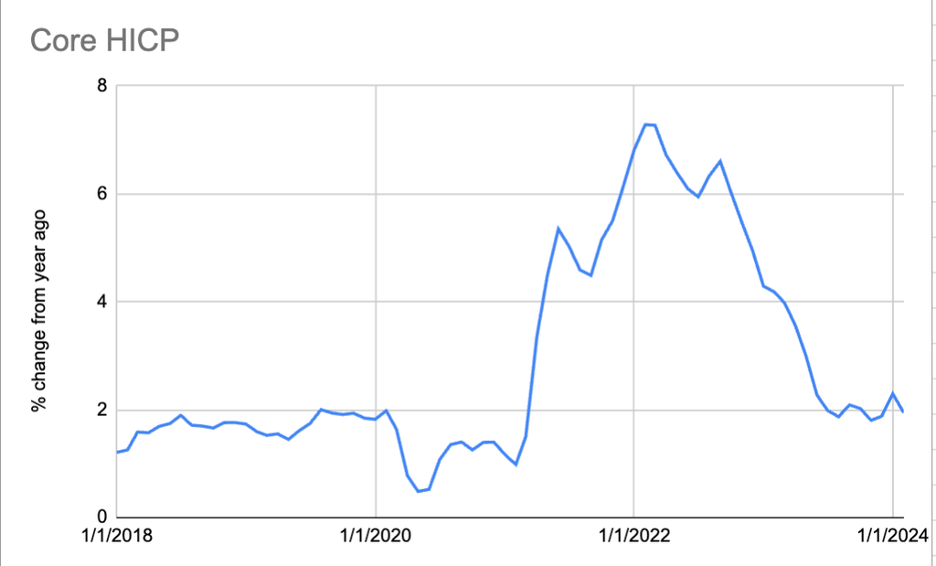

Here’s a chart of historical inflation, going back to 2018:

The Harmonized Index of Consumer Prices is a cleaner measure of inflation because it takes out some of the estimated and imputed numbers used in the CPI. Inflation was driven up during COVID and has gone back toward “normal” over the past sixteen months. But like we just saw midweek, there’s still pressure keeping it over the Fed’s Target. People continue to spend money at a breakneck pace. That’s what needs to cool — particularly since some of that spending is being funded with 30% credit card rates!

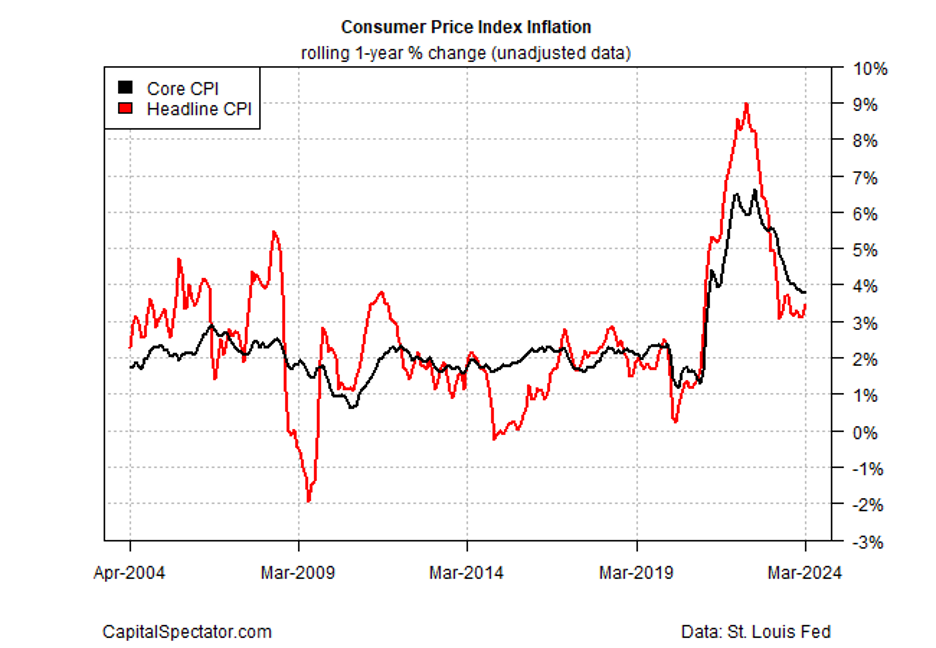

So, what just happened to financial markets this week? A teeny blip. Here’s a chart of recent CPI and Headline CPI. The little red bump at the far right bumped a little higher this week and the markets went down on Wednesday and today. While caution is one thing, over-reaction is quite another. That’s why you’re hearing the “buy on the dip” mantra from some analysts. It’s not yet an inflation trend – it’s still a blip. And when the blip stops there will be an over-reaction in the other direction.

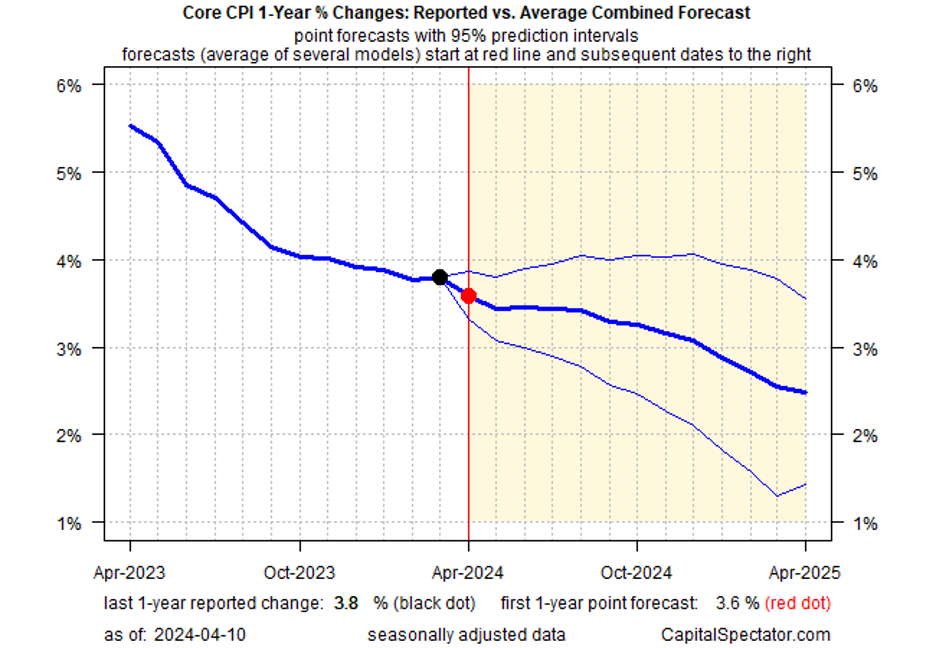

Finally, here’s a forecast chart that gives you a composite estimate using past date and consensus forecasts. The dark blue line is the expected future inflation rates, and the light blue lines give you the standard deviation based high side and low side ranges for inflation.

While projections don’t “guarantee” anything, they give you a better sense of where the economy could be headed beyond the next six hours or the next few days. I think we have the best Federal Reserve Board that we’ve had during my 70+ years. They are a group of incredibly smart and well-educated people. They are equipped with better data than in the past. They are trying to steer our economy in a way that serves all Americans. They are behaving like fiduciary stewards, not political hacks. All of this gives me great comfort in such our uncertain world.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2024 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.