What’s the Deal with Housing Costs?

There was a time when I naively believed that if everyone owned their home then the world would be a better place. They would naturally care for something that was “theirs” better than something that was someone else’s. The past thirty years has proven to me how wrong I was for two reasons:

One: Maintenance & Insurance

First, there’s no course in school on how to maintain a home. Changing the HVAC filters and scraping plates before they go into the dishwasher are the least of the issues. There are so many hidden things that can happen in a home, it’s overwhelming. Water can end up causing damage that may not show up until it’s very expensive to repair. Black mold can appear where you never expected and it’s expensive to remediate.

Our house is fifty years old. We recently purchased a new washer. The installer connected the hoses and water started shooting everywhere. He calmly said, “Time to call your plumber.” Who knew that over fifty years the little drainpipe that goes down to the sewer line would get coated with layers of stuff that would inhibit newer washers from slinging out the massive amounts of water – faster. Sure enough, it took the plumber ten minutes to run some gizmo down the drain, clearing it out.

So, point one is that maintaining houses can be frustrating and more expensive than you expected and maybe more than you put into your budget. Along that line, who knew that Homeowner’s Insurance was going to skyrocket after a couple of years of natural disasters from coast to coast to coast. The cost of home ownership has become greater than ever.

Two: Affordability

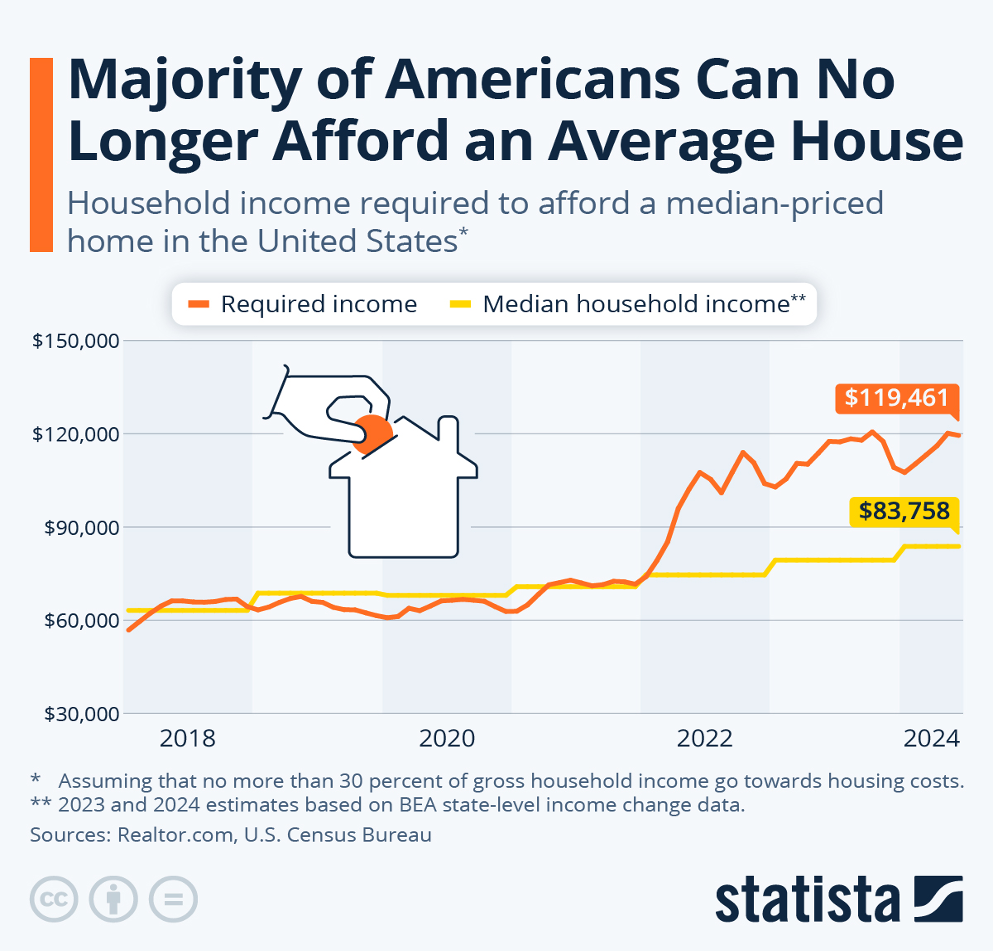

Second, the 2008 Financial Crisis revealed that many home mortgages were under-collateralized and under-supported by financial resources. People were simply buying more house than they could afford. Home financing rules were changed. Here’s a chart that shows the impact that’s made for the income Americans need to purchase an “average” home.

Prior to 2018 Median Household Income was slightly greater than $60,000 and the required income to purchase an average home was slightly less than that. Today Median Household Income has risen 41%, yet the income required to purchase the average home has risen 102%! The problem is being caused by the rapid escalation in housing prices. In 2018 the Median Home Price was $280,000. Today that number is $439,170.

While this may not impact your personally, I would guess that it impacts someone you love. Affordable Housing is a real issue in this country. Whether it is a rented housing or a debt-based owned housing, it’s important that rational solutions evolve. I don’t know that either political party has a solution, but I’m hopeful that a national discussion evolves that makes things better for our kids and grandkids. Our current path is not sustainable.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2024 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.