What We Have Learned from the Silicon Valley Bank Collapse

The nation’s sixteenth largest bank collapsed March 10, 2023. Silicon Valley Bank (SVB) was founded in 1983 to serve the needs of entrepreneurs in the Silicon Valley area, providing banking services and venture capital financing for the private equity, technology and California wine industries. Over the years, it had grown to become one of the largest banks in the United States

SVB’s collapse is the second-biggest bank failure in U.S. history. Customers withdrew $42 billion (a quarter of the bank’s total deposits) in a single day. The institution’s failure happened in less than 48 hours.

These events created turmoil in the financial markets and concern in individuals. Fortunately, since Silicon Valley Bank’s failure other financial institutions and the markets have stabilized. What lessons can we learn from the last two weeks?

What caused the SVB failure?

In many ways SVB was a victim of its success. During COVID private equity and Venture capital had few investment options. They had to park their cash somewhere and Silicon Valley Bank was their bank of choice. In 2021 alone SVB saw an increase in deposits of $78 billion. SVB never did as many loans as traditional banks, and during COVID they did even fewer loans. They needed to invest their cash and they decided to purchase long-term Treasury bonds, which typically deliver small but reliable returns amid low interest rates. Inexplicably, there was no plan to hedge the risk as the Federal Reserve aggressively hiked interest rates over the past year, and those holdings lost significant value. Most of these losses would go away when the bonds matured, and principal was returned.

The group of depositors in Silicon Valley Bank was a small set of venture capital firms, tech startups and other large investors. After a poor financial report, some of the depositors discussed their reactions in WhatsApp and Slack groups devoted to startups, the Wall Street Journal reported.

Many of these depositors had millions of dollars parked at SVB. They became aware of the significant risk to their capital since the FDIC insured their cash up to only $250,000 of deposits.

In a digital environment marked by easy cash withdrawals and the spread of information on social media and other spaces online, panic among a few can grow into a stampede for the exit. “This was the first Twitter-fueled bank run,” Rep. Patrick McHenry, R-N.C., the chair of the House Financial Services Committee, said in a statement days after the fall of Silicon Valley Bank.

If depositors had not panicked and left their deposits in SVB the marked to market loss on their Treasury bond portfolio would have gone away as the bonds matured. Instead, they started to withdraw their funds forcing the bank to sell the bonds and book the losses. Quickly the bank had a negative cash balance of $958 million. SVB closed the next day.

In our banking system there is safety mechanism for banks to access cash. They can post assets as collateral to the Federal Reserve who acts as a lender of last resort to lend cash to the banks who need cash. Silicon Valley bank fell victim to the U.S. government’s antiquated computer systems.

The Wall Street Journal reported on the timeline of events:

”Withdrawals accelerated late in the morning on the West Coast on Thursday, March 9. Executives paced the office on phone calls as employees watched and texted details to each other.

That is when SVB, at the time controlled by SVB Financial Group, started looking for help, only to run into the U.S.’s bank-funding system, which wasn’t built for speed. First it turned to the San Francisco Federal Home Loan Bank, asking for a $20 billion loan.

It was already midday in California, and SVB’s unusually large request came too late for the San Francisco FHLB to process that day, people familiar with the matter said. It offered SVB a smaller loan, but the bank turned that down, the people said.

SVB turned to plan B, asking the San Francisco FHLB to move $20 billion of collateral to the Federal Reserve’s discount window, where it could get emergency funding, the people said. SVB had $20 billion available for financing at the San Francisco FHLB, according to the people familiar with the matter.

The bank hit another roadblock. The transfer required procedural steps. SVB had outstanding loans at the San Francisco FHLB, which had to determine how much collateral it needed to hold, the people familiar with the matter said.

SVB also tried to get $20 billion in assets to the Fed through Bank of New York Mellon Corp., one of its custodial banks. SVB was too late—it had missed BNY Mellon’s daily cutoff for instructions for Fed transfers from custodial accounts.

BNY tried to extend its cutoff, but:

The Fed needed a test trade to be run before the actual transfer could occur. That took time and the Fed didn’t extend its own daily deadline of 4 p.m. PT for collateral transfers to help SVB. Time ran out on the bankers and SVB couldn’t get the money that day.”1

The FDIC seized the bank the next day.

Rapid action from the Treasury Department, Federal Reserve, the FDIC, and the President stabilized the situation.

Recognizing the systemic risk of other bank runs and failures the FDIC, Treasury Department, and the Federal Reserve organized a plan to quickly reassure depositors and the financial industry. That Saturday they released a statement that The Federal Deposit Insurance Corporation (FDIC) will address the Silicon Valley Bank failure in a way that “fully protects all depositors, both insured and uninsured.”

This decision to make all SVB depositors whole (even those with cash deposits above the $250,000 FDIC protection threshold) went a long way towards stabilizing markets.

Treasury Secretary Janet Yellen made the decision after recommendations from the boards of the FDIC and the Federal Reserve, and after a consultation with President Joe Biden. This will “reduce stress across the financial system, support financial stability and minimize any impact on businesses, households, taxpayers, and the broader economy,” the statement added.

They also announced that they would make more funding available to other banks to help them meet the needs of all depositors. The Fed will make this financing available through a new program, called the Bank Term Funding Program (BTFP), that will offer loans up to one year long to banks as well as savings associations, credit unions, and other eligible depository institutions that are “pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral.” The BTFP is intended to offer such banks and lenders another source of liquidity and so eliminate the need to quickly sell those securities, as SVB did shortly before its demise. The Treasury Department will make up to $25 billion available as a backstop for the BTFP.

Inflation control is still the Federal Reserve’s priority.

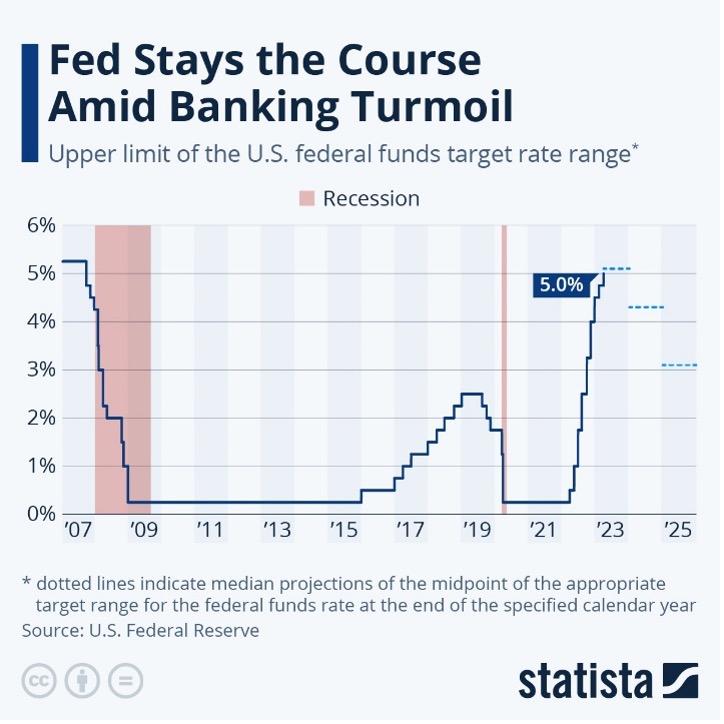

Jerome Powell and the Federal Reserve were scheduled to release their next interest rate decision a few days after the emergency actions that were put in place to stabilize the US financial system. Many pundits expected a pause in their plans to increase the Federal funds rate. (Expected to be another 0.5%) They felt that increasing the funds rate could increase the stress on other banks.

In their statement they reiterated their goals of achieving maximum employment and a long-term inflation rate of 2%. Looking at the continued high inflation rate they increased the Fed funds rate by 0.25% to 5%. They did signal that they may be approaching their last rate increases.

Regional Banks are safe and financially stable.

Regional banks are more regulated than SVB, which had lobbied for reduced oversite because of its “different’ business model. They are not allowed to have unhedged interest risk exposure and are subject to a broad range of capital requirements and enhanced stress testing.

In addition, Janet Yellen reassured bankers that she was prepared to intervene to protect smaller banks and depositors.

There is a new awareness about the risks of large cash deposits in banks.

All of us have been reminded that the FDIC $250,000 cash deposit protection limit may be insufficient.

Janet Yellen has made it clear that the “make whole” deposit loss policy for SVB customers will not be extended to all other losses. They will determine this on a case-by-case basis.

Just this week the online personal finance company, SOFI announced that they are increasing FDIC coverage from $250k to $2 million for client checking and savings accounts. They have created the SOFI FDIC Insurance network, a partnership with multiple banks so that they can seamlessly place deposits with FDIC insured partner banks.

I expect other institutions will also address the FDIC insurance shortfall with other creative solutions.

References

1Miao, H., Zuckerman, G, and Eisen, B. (2023, March 22). How the last-ditch effort to save Silicon Valley Bank failed. Wall Street Journal.

Ralph Broadwater, M.D., CFP®

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.