The Dow 30 Revisited

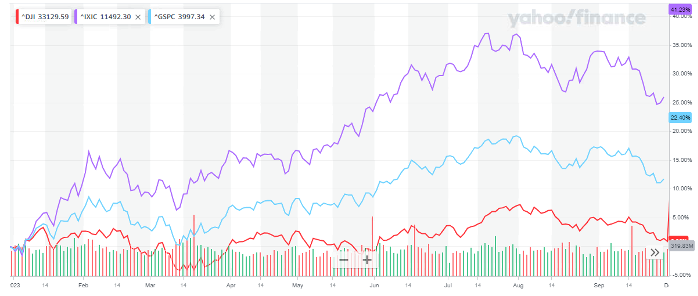

When I last wrote about the Dow Jones Industrial Average, less than two months ago, my question was, “What’s Going On With the Dow?“ Here’s what the chart looked like over the previous twelve months. The purple is the NASDAQ; The blue is the S&P 500; and the Dow 30 is the red line. Not a pretty sight!

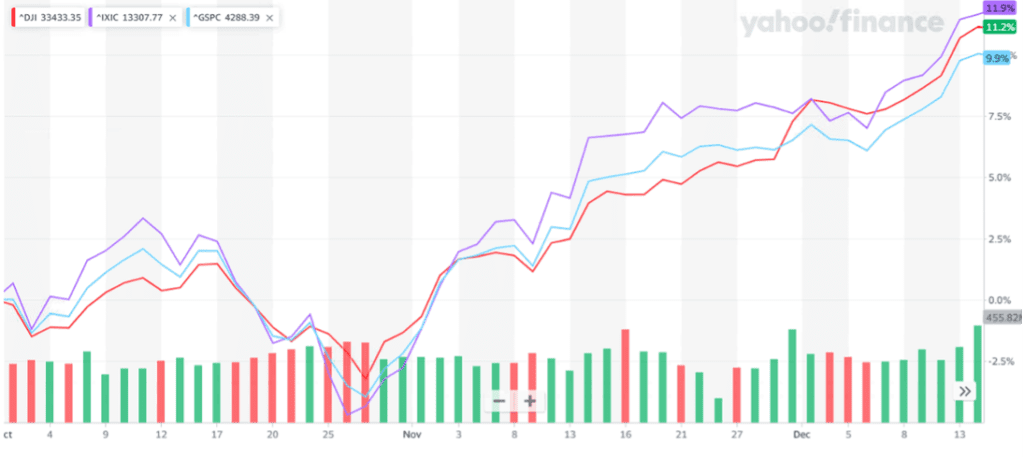

Here’s what these three indices have looked like so far in this quarter. Note that October was abysmal for the first 27 days. Seven out of eight consecutive days were negative. I really don’t enjoy those periods!

And then the sun came out. Since then, we have only experienced eight down days in the Dow! The Dow has actually kept pace with the other two major indices and is ahead of the S&P 500. The Dow has gone from 32,417.59 on October 27th to 37,208.32 a few moments ago. That’s a 14.78% increase in 33 trading days. With two weeks to go, this may end up being a pretty good year, in spite of how things looked in October!

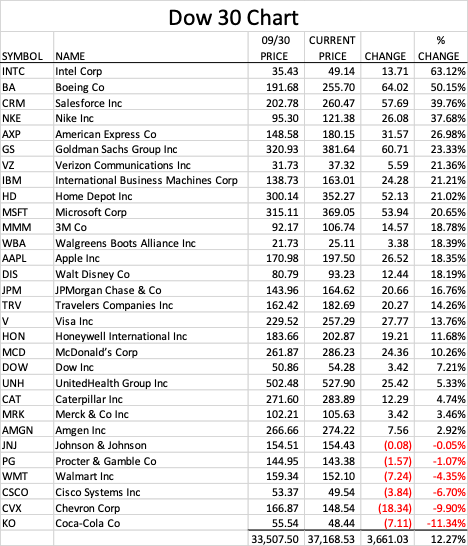

In the chart I provided with the quarterly report, only eleven of the thirty Dow stocks were positive. Most of those were involved in the Technology sector. Here is a chart of performance for the Dow stocks this quarter. Only six of the thirty stocks have been negative for this quarter.

Let’s keep our fingers crossed for a stable next two weeks!

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.