The Debt That Really Matters

There have been and are likely to be future efforts by government to stimulate our economy. As a result of the 2020 Stimulus Packages, this year’s Stimulus Package and now with a discussion of an Infrastructure Package, there is more scrutiny of the National Debt. My education was focused on Microeconomics, the economics of the firm. That data is more quickly available and timely. It was measurable, easily analyzed and simply more definitive (provable). One plus one always equaled two. It’s pure algebra and calculus.

Macroeconomics

Macroeconomics is more global in nature. It theorizes the larger-scale groupings, like the entire United States economy or the World Economy. British Economist John Maynard Keynes is generally viewed as the father of Modern Macroeconomics. He brought an entirely new way of viewing the economy of the country and world during the Great Depression with the publication of The General Theory of Employment, Interest and Money. Under his broad theories one plus one never equals two; it is generally anywhere from three to seven or more! The concept of multipliers has been true in practice; the debate is over “how much of a multiplier” is accurate.

Keynes was a major influence over Canadian/American Economist John Kenneth Galbraith. He had a major hand in the efforts and policies of the Roosevelt Administration to extract us from the Great Depression. Galbraith later served in the Truman, Kennedy, and Johnson administrations, influencing economic policy.

I grew up in a household where Galbraith’s views were anathema. Milton Friedman was “the man,” because he applied a more micro view on macro issues. Galbraith’s ideas were viewed as dangerous. Yet, in the words of the great philosopher Lou Holtz, “Nothing is as good as it seems and nothing is as bad as it seems. Somewhere in between is reality.” The challenge of being an economist (or wholesale buying into one economic theory) is that given enough time, some, if not all your theories will be proven wrong in real-world practice. They will be exposed as containing false assumptions. Ultimately, they are theories, not “truths.”

The financial collapse of 2008-09 and again last year with the economic threat from the COVID virus, provided more clarity on the practical truths of Macroeconomics. No longer have the sides simply formed along political lines. Ironically, even the Republican players in the Bush Administration during Financial Crisis of 2008-09 quickly learned that there was genuine value in stimulus. These were some of the same players, now on the Federal Reserve Board, who pushed through the stimulus packages last year. That stimulus led to far greater (i.e., multiplied) economic activity, and kept our economy from stagnating.

Household Debt Good and Bad

While I do believe there are limits on how much stimulus becomes “too much,” I am far more concerned over another very large form of debt – Household Debt. This debt has real, personal consequences. There is nothing theoretical about it. There is both good debt and bad debt, from an income tax and behavioral perspective.

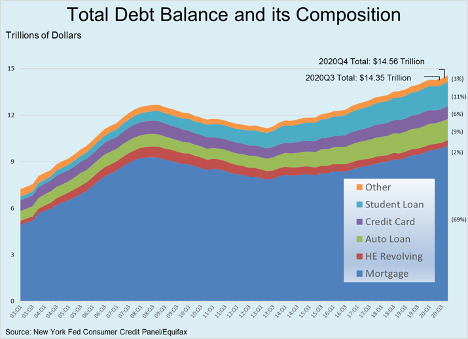

The chart below, contains information compiled by the Federal Reserve Bank of New York. It shows Household Debt going back to Q1 of 2003. It contains aggregate data on traditional Mortgage Debt, Home Equity Revolving Debt, Auto Loans, Credit Card Debt, Student Loans and “Other.” Over the past eighteen years Personal Debt has roughly doubled to $14.56 Trillion at the end of 2020.

Mortgage is Good Debt

On this chart, Mortgage Debt is the only “good debt,” and then only if you itemize on Schedule A. The “anything goes” mindset of mortgage debt prior to the 2008 financial crisis was a major reason for the near collapse. As a result, new rules went into place to make sure that a homeowner had adequate resources to repay their debt. Moreover, the true value of the home was more scrutinized so that the borrower had more skin in the game and the mortgage debt was assured to be a smaller percentage of the true value. Mortgage Debt has increased over the past eight years. This is due to historically low interest rates, yet this debt is better collateralized by assets of more certain value.

The Rest is Bad Debt (or less attractive)

The remaining forms of debt are far less attractive. The interest on Home Equity Loans is no longer deductible and the rates are considerably higher than on a traditional Mortgage Loan. They aren’t as expensive as credit card debt due to their collateralization. Because they aren’t structured to be repaid over a set period, they can become silent time bombs, like a credit card.

Credit Card debt is generally the most expensive form of credit. While most credit cards have very low introductory rates, as with your cable bill, this never lasts. They can jump to a 24% rate before you know it. The effort to keep rolling to other credit cards would be better spent by figuring out how you can pay them off before retirement.

Student loan interest isn’t quite as bad as credit card interest, but not by much. There is a student loan interest deduction on federal income tax for up to $2,500 of interest. This deduction is available if your MAGI income is less than $70,000 per year. It phases out between $70,000 and $85,000 (double these numbers if you file a joint return). Additionally, student loan interest has been suspended until September 30, 2021 due to the coronavirus crisis.

Debt is a Drag on Your Cash Flow

My boomer generation grew up in the hyper-inflation years where debt was the logical solution. Debt was good. That is no longer the case. In retirement, debt is a massive drag on your cash flow. Every thousand dollars of monthly debt service cuts your cash flow by a thousand dollars. It makes retiring comfortably a challenge. We encourage clients to get all their debt paid off before they retire. Otherwise, they aren’t going to enjoy their golden years nearly as much. They simple won’t have adequate cash flow.

If this is a challenge for you, I recommend Mary’s article on our Save-to-Spend system. You may want to consider taking a Dave Ramsey course.

The sooner you shift from spending borrowed money to spending saved money, the sooner you are free of the tyranny and slavery of debt. This is what really matters!

As always, we are here for you. Please email or call if you want to set up a Zoom videoconference meeting or talk by phone.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2021 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. (“AFG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AFG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of AFG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a AFG client, please remember to contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. AFG shall continue to rely on the accuracy of information that you have provided.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.