Rising Interest Rates

Interest rates have been on the rise since the beginning of 2022. This has been great if you’re retired! We’re beginning to see rates move back toward the levels we saw from 1995 to 2005. CD rates are surprisingly high. It’s a “lender’s market.”

Much of this is a result of the Federal Reserve raising the discount rate. The rest of it is due to inflation creeping up over the past three years. The future problem with that “interest rate driver” is that inflation has declined substantially this year.

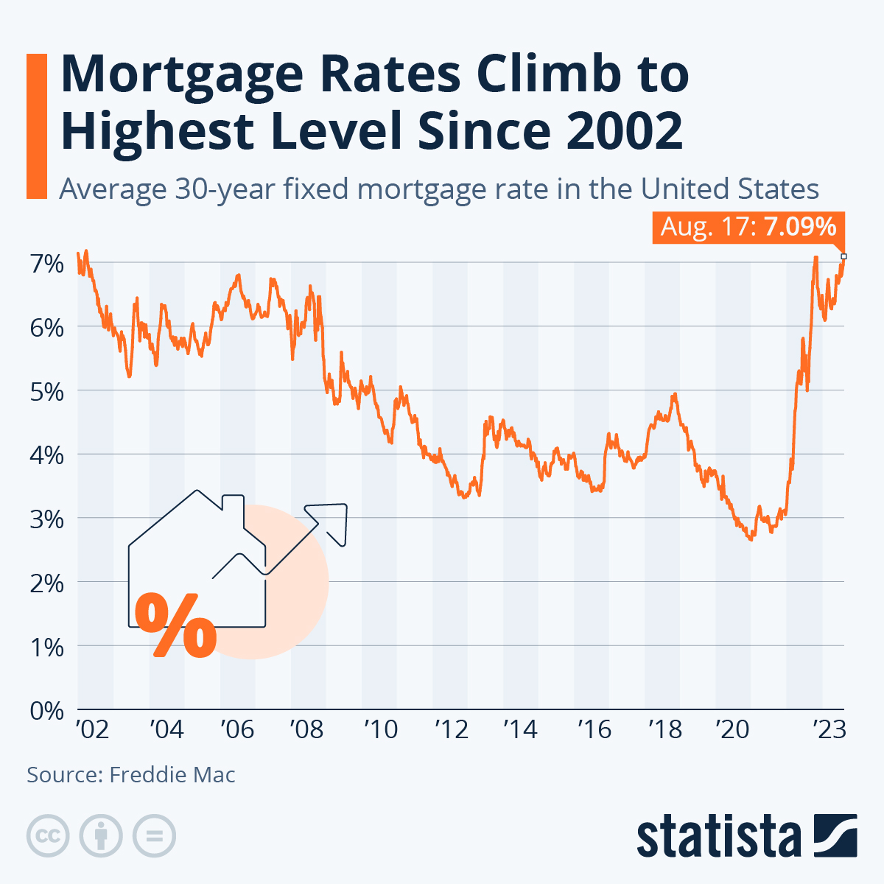

Here’s the flip side of rising rates – if you are buying a new home, you’re not going to be able to obtain a 2.75% mortgage like you could in 2021! Mortgage Rates have gone back to the levels of twenty years ago. Keep in mind, those rates are still a far cry from 1975 to 1995!

Our first mortgage was 8.125% in 1976 and we got a steal! We qualified for “bond money” as first-time home buyers. The market rates for mortgages were around 14%!

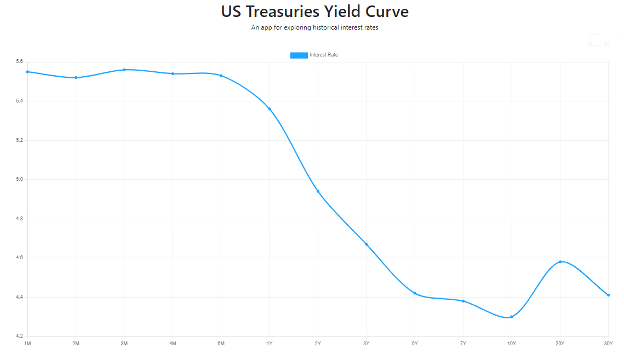

Today’s interest rates aren’t likely to persist. Here’s an interesting chart from the Treasury which shows today’s Yield Curve. This shows you the rate you will be credited, depending on how long you are willing to tie up your money. If you invest money for six months or less, you’ll earn between 5.0 to 5.5%. Notice what happens after that – as time periods increase to 1 year, 2 years, 3 years, your rate goes down precipitously! A ten-year Treasury will “only” pay a little over 4%. Granted, that’s four times what they were paying not long ago.

What’s the most important take away from these interest rate changes? It is critical to try to reduce or eliminate non-mortgage debt as soon as is practical. The interest rates on credit cards, lines of credit and “retail” car loans are going to be increasing – and in some instances, substantially! These rates are based on today’s environment and more importantly, today’s expectations. The market (meaning human beings acting collectively) thinks that rates are going to moderate. The market doesn’t see rates going back to the sweetheart days of three years ago. It looks like it’s going to be more profitable to be a lender of your funds than a borrower of someone else’s funds for the next few years.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.