My, How Times Have Changed

Perhaps you remember 2005. Through early August of the previous year, the DOW was down about -6%; the S&P 500 was down -4% and the NASDAQ was down over -12%. This was the second-term election year for George W. Bush. Despite it being an election season, the markets roared back over the next few months with the DOW ending 2004 up 2%; the S&P and NASDAQ up about 9%. Things were rocking along smoothly.

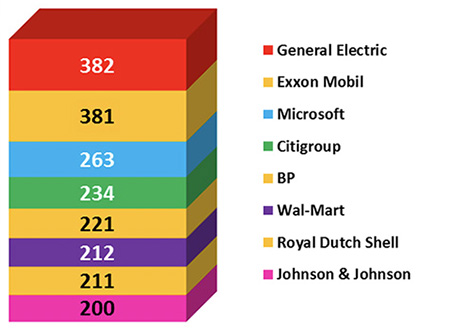

The stock market was driven by these eight “mammoth” companies (the numbers in the chart are in billions). Remember, this was pre-Financial Crisis. We were blissfully ignorant of what was going to happen in 2½ years. General Electric was a giant conglomerate that “owned the world.” The three big oil companies represented about 40% of this group. Microsoft, the sole tech company represented 13%. This was the way the financial world looked at the time.

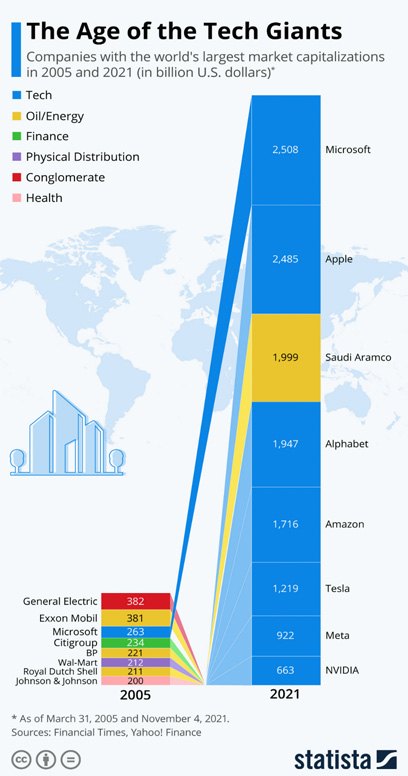

I wanted you to have this context so you could easily see how differently today’s financial world looks. Today, the top eight companies are 6.4 times larger than the top eight in 2005. Seven of the eight companies are in the Tech sector.

Only Saudi Aramco, in the Oil/Energy sector keeps today’s list from being a clean sweep for technology. Microsoft, the sole tech company in the 2005 list, is the largest company for the moment. Google and Facebook are in the mix, but they’ve changed their names to Alphabet and Meta, respectively.

The chart below puts the changes in perspective. It’s honestly a challenge for the human brain to absorb the differences. Most of us are still thinking from an older framework. There are benchmarks where the world changed: 9/11, the Financial Crisis, Presidential Elections and of course, COVID pandemic. Yet, the change in this comparative chart happened somewhat gradually over the past sixteen years. While we weren’t watching, the financial world changed dramatically.

As you contemplate the future, ask yourself, “What could go wrong with these “Blue Companies?” Who will be the “winners” from this list? What are the threats they face? What are their limits to growth? What might this chart look like in 2037? By the way, how old will you be in 2037?

I have a friend who used to regularly watch one of my favorite shows, Wall St. Week with Louis Rukeyser. We’ve talked about how comforting it was then to hear from Louis and his guest experts discuss the world, the “market” and the companies who were positioned to do well. This chart shows why that’s so challenging now. Fifteen years ago, you had not even heard of most of these eight companies. Let alone, would you have expected them to dominate the financial world today.

Going forward, an investment process that looks at big picture asset classes is going to be increasingly important. Stock selection is going to be a less dependable way to grow wealth. We’ll keep adapting to accommodate the likely changes. As they say in the west, “You might want to hitch your britches.”

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2021 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.