From Event to Season

For years Black Friday was THE event. Stores would open at 6:00 am with shoppers jostling to get closest to the door. At the appropriate time they would storm the door like the French did the Bastille!

I remember one year, my son-in-law and I got up early to go to Home Depot’s Black Friday extravaganza. We arrived to join the throng of twelve other guys waiting to buy a $29.99 Shop-Vac. At precisely six, there was a great roar next door, like the ones in Razorback Stadium when the Hogs score, as the hundreds of shoppers waiting to get into Target expressed their glee at the doors opening! I asked my compatriots if we should also roar. Sleepy grins were their only response.

That’s the last time we’ve gotten up early to go to Home Depot on Black Friday. We both noticed that, unlike Walmart and Target, three weeks later most of the “deals” were still crowding the middle aisles. I still enjoy buying the cheap flashlights for the grandkids. They think it’s a hoot turning them on and running around.

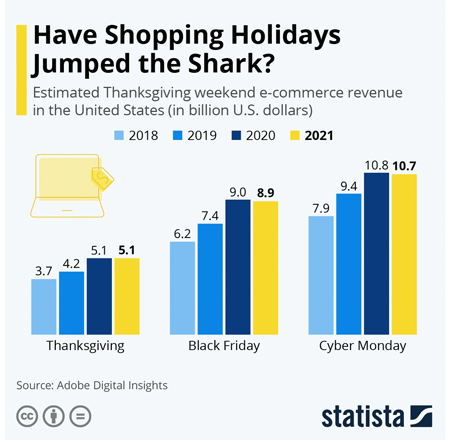

Alas, those Black Friday events are waning. For the past four years Cyber Monday has consistently exceeded the sales levels of Black Friday. This year we experienced something else that was new – sales on Black Friday and Cyber Monday declined slightly from last year. I predict this will become a pattern. This is in spite of Black Friday having been stretched backward to 6:00 pm on Thanksgiving. People simply don’t want to join a wild-eyed throng of hooligans willing to do whatever is necessary to get one of the four remaining 56-inch TVs on sale for $437! There’s a better way to shop.

None of this means that Christmas sales have declined. People have simply become accustomed to buying almost everything online – they see that as the “better way.” In fact, between November 1 and November 29, we spent $109.8 Billion online! That’s an increase of 11.9% increase over last year. Black Friday is no longer an event; it’s become a season.

Now if you’re a bit of a procrastinator, never fear. Even though Black Friday was a week ago, many Black Friday/Cyber Monday sales are still running full blast. Additionally, Amazon has improved their logistical skills to the point that you may be able to order gifts on Christmas Eve and have them delivered by Christmas Morning – well before your teenage children or grandchildren are awake.

All of this is a little sad. You’re unlikely to get the same adrenalin rush from buying online. It doesn’t compare with desperately scrambling around town looking for a Cabbage Patch Doll for your little girl on Christmas Eve. Then, when you’re about to give up and leave Service Merchandise, you spot one miraculously sitting up on a ledge by one of the checkout aisles. That’s how Wallis Everard became a member of our family and put a smile on Sarah’s little face that I’ll never forget! Now that was a rush!

Marietta Trina joined our family a couple of years later putting a similar smile on Laura’s face, but the stress and adrenaline surrounding her arrival was, thankfully, far lower.

However, you choose to do it, Happy Shopping. You have twenty-one shopping days until Christmas!

Rick Adkins, CFP®, ChFC, MBA

P.S. The phrase “jump the shark” is used to suggest that someone is engaging in a misguided attempt to generate new attention or publicity for something that was once perceived to be, but no longer is, widely popular. It was the result of Episode 3, Season 5 of “Happy Days” where Fonzie, water-skiing in swim trunks and his leather jacket, jumped over a shark. You would have difficulty topping that!

![]()

© 2021 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.