Approaching Retirement

Dr. Tobin, a Cardiologist for 25 years, wants to know when he can retire and what additional planning he needs to do.

*These fictitious scenarios are designed to generally illustrate how we may provide our services to a client. Keeping in mind that no two clients, situations, or experiences are exactly alike, these scenarios are not to be construed as an endorsement of the Firm by any of its past or current clients, nor any assurance that we may be able to help you achieve the same results.

Thomas Tobin, MD* is a 56-year-old Cardiologist who has been with the same group of doctors since he completed training. The past decade has brought a number of changes to his clinic through a series of mergers with other groups. Additionally, uncertainty with the future delivery of healthcare has added to the atmosphere of instability that Tom feels. He’s watched some of his original partners retire earlier than he expected and is wondering when he should seriously be looking at retirement himself.

Tom is married to Sarah, 55, a CPA and Audit Partner with a local CPA firm. Sarah is much more comfortable with the business aspects of life and keeps up with their checkbook. They have one child together (Tim, 12) and one child each from their previous marriages (William, 21 who lives with his Mom and Molly, 19 who lives with them).

Overview

Dr. Thomas Tobin

- Age 56

- Cardiologist

- Annual Income $540,000

Sarah Carter Tobin

- Age 55

- Certified Public Accountant

- Annual Income $215,000

Family Finances

- Home in affluent neighborhood valued at $630,000

- Home mortgage of $502,000, 5.125% w/ 28 years left

- Tom’s Retirement Plan balance $1,093,000

- Sarah’s Retirement Plan balance $416,000

- Joint Investment Account balance $368,000

Tom and Sarah’s Concerns

Determining what they will need to do to be able to retire: How long will they need to work? How much should they be saving, both in their retirement accounts and in their investment account? What changes will they have to make in their lifestyle? When should they start drawing Social Security?

One of Tom’s partners bought a vacation home on the Gulf Coast. They are interested in the merits and drawbacks of doing something similar.

How We Suggest Helping Dr. and Mrs. Tobin

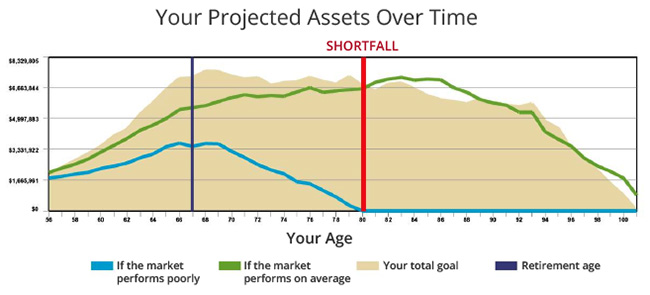

Tom, like most clients, might want to see what their retirement looked like if they fully funded their retirement plans until the age of 67 and then lived on $20,000 per month in today’s dollars. We ran retirement projections (see below) for this scenario assuming they waited until age 67 to also begin drawing Social Security. No outside savings were assumed. The calculations were made using a Monte Carlo simulation that reruns the model hundreds of times so that a more likely outcome can be seen.

The chart below shows that if markets perform as they have historically, the Tobins will run out of money when Tom is about 100. If markets perform poorly over that same time period, the Tobins could run out of money as early as when he is 80. This gravely concerned both of them, considering what they had experienced over the past twelve years. They wanted to push that out to age 90 by:

- Working longer,

- Saving more in their investment accounts, or

- Spending less in retirement.

Their options became, 1) working for four more years – until age 71, or 2) Saving $9,178 more per month, or 3) decreasing their spending by $7,000 to $13,008 per month in retirement. They ultimately saved more and worked longer. By monitoring their progress each year, they were able to actually retire a couple of years earlier.

We visited with the Tobins about where they had vacationed in the past and what they enjoyed about travel and where they hoped to visit one day. They concluded that they really wanted to spend whatever vacation time they had while their children were available on a beach. They had enjoyed the Gulf Coast in the past and estimated that they would only have three to four more years with the children all able to participate. After that, family challenges would make that difficult. They would then want to spend vacations visiting various areas in Europe. They both enjoyed history and wanted to plan these trips so that they could see a number of museums, galleries and architectural sites. The more they thought this through, being stuck in one place didn’t really achieve their goals.

*These fictitious scenarios are designed to generally illustrate how we may provide our services to a client. Keeping in mind that no two clients, situations, or experiences are exactly alike, these scenarios are not to be construed as an endorsement of the Firm by any of its past or current clients, nor any assurance that we may be able to help you achieve the same results.

Hypothetical client

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.