Beyond the Noise

This has not been a warm and fuzzy month for financial markets. Today, January 28th, was the first encouraging day in some time. It has been easy to get caught up in the negativity and the maxims that accompany these periods, “When the Fed raises rates, the Stock Market Declines,” “When the market is down in January, the Stock Market has a bad year,” etc. The economy, and thus the stock market, is far more complex than these anecdotal concepts.

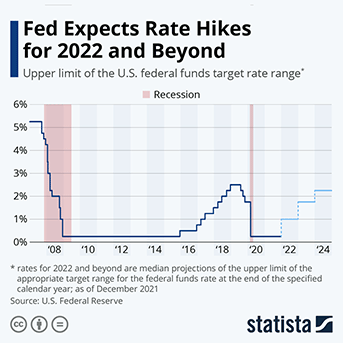

Before we look at the “Big Picture” of Consumer Spending and growth in the economy, let’s look at Fed rates, in context. The chart below shows Fed Rate changes going back to pre-Financial Crisis days. In 2007 the Fed Rate was at 5.125% and everything appeared to be hunky-dory. Then sub-prime mortgages blew up and blew away several massive financial institutions. To save the economy the Fed whacked rates over the next two years to 0.125%! They remained at that level for seven years.

Then, due to concern for overheating the economy, over the next 3½ years rates were incrementally bumped up to a whopping 2.5%. Rates stayed at that level for much of 2019 which was our last big return year in the stock market. Then COVID hit and to help keep the economy afloat, rates were lowered to 0.125% again.

When you look at the forecast in the chart, the Fed is anticipating raising rates back to the 2.125% level by 2024. That’s less than half the level from 2007! Yet you see articles and hear stories predicting that the sky will fall because the Fed is going to raise rates. As Lee Corso would say, “Not so fast, my friend!” When put in a historical context, this has not and should not, on its own, cause a financial meltdown. More importantly, if it helps the Fed manage inflation, it will be a good thing.

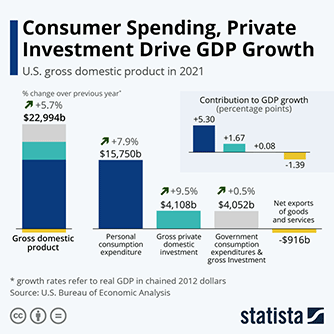

Now to more important data, despite the Delta and Omicron variants of COVID, political turmoil, and a great deal of negative press, THE U.S. ECONOMY actually grew 5.7% in 2021. In fact, the only component of GDP that didn’t increase last year was Net Exports. This is a far greater indicator than Fed Interest Rate changes.

It will be interesting to see the impact that infrastructure spending will have on the economy over the next two to three years. That’s a variable that no one seems to be considering. It could have a positive impact on both Private Investment and Government Spending. While GDP may not grow at 5.7% in 2022 and 2023, these two components could have a very positive impact on overall GDP these next two years.

When you hear the daily financial News Noise, keep it in perspective and realize that one variable won’t generally be the sole driver for what happens in the future. It’s great at getting your immediate attention but limited in being the silver bullet for portending Doomsday.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2022 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.