Something Old, Something New

SOMETHING OLD

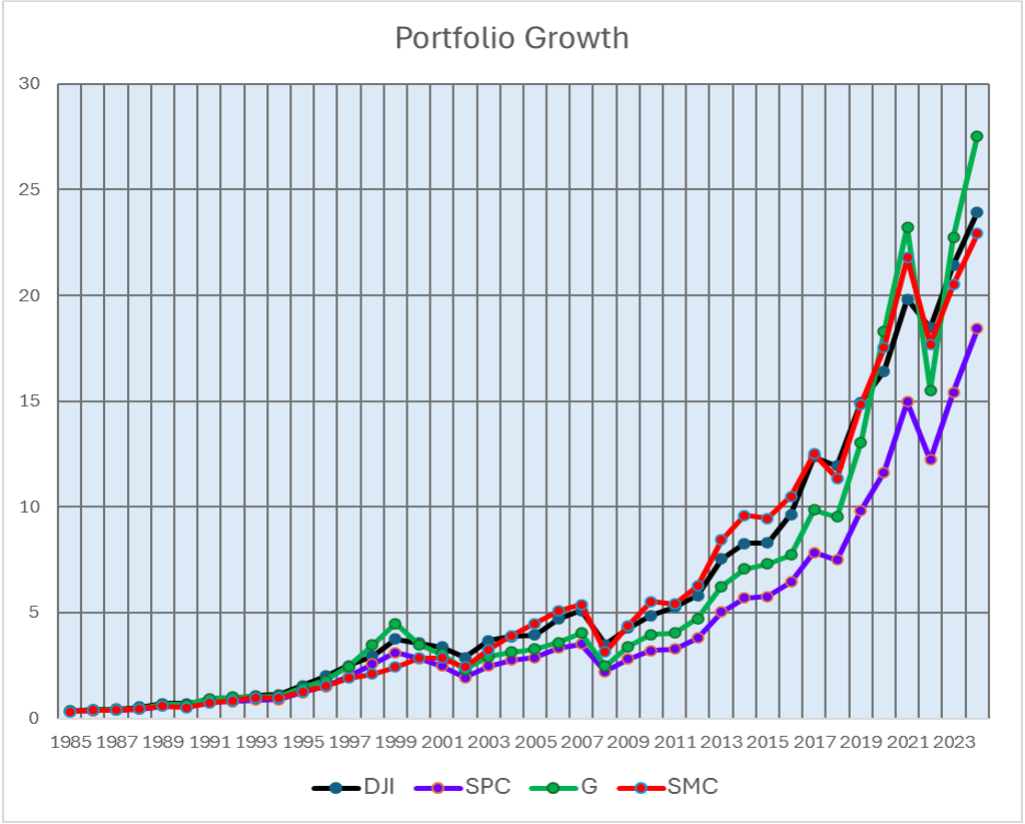

Our firm first registered with the S.E.C. in 1985. My life experiences with the major Asset Classes is very different from someone who uses a shorter-term perspective. Rather than suffering from “recency bias,” I tend to suffer from a “historical bias.” The chart below captures my lived experience with the four largest asset classes in our system: Dow Jones Industrials, S&P 500 Composite, Large-Cap Growth Stocks and the S&P Mid-Cap 400.

Harry Markowitz won the Nobel Prize in Economics in 1990 for his groundbreaking work on Portfolio Optimization. We started using Portfolio Optimization Software shortly thereafter, but it took a few years to harness its power (assisted by increasingly faster computer processors). By 2000, I rarely saw Large-Cap Growth, or the S&P 500 show up in allocations. That didn’t change until about four years ago. From 2002 until 2018, the Dow and Mid-Cap consistently outperformed Growth and the S&P 500.

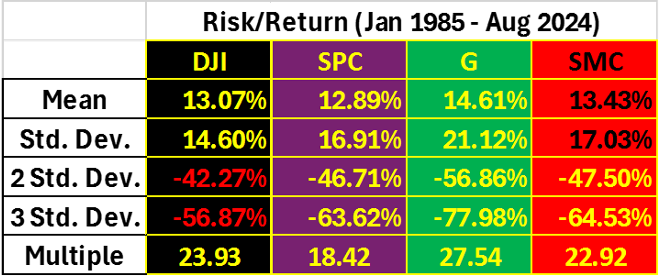

The table above shows the average return for the entire period of the chart. It also includes the level of Risk (Standard Deviation) and the resulting downside both 95% and 99% of the time. In extreme periods, the downside of Growth is 78%! Most people can’t stomach that kind of loss.

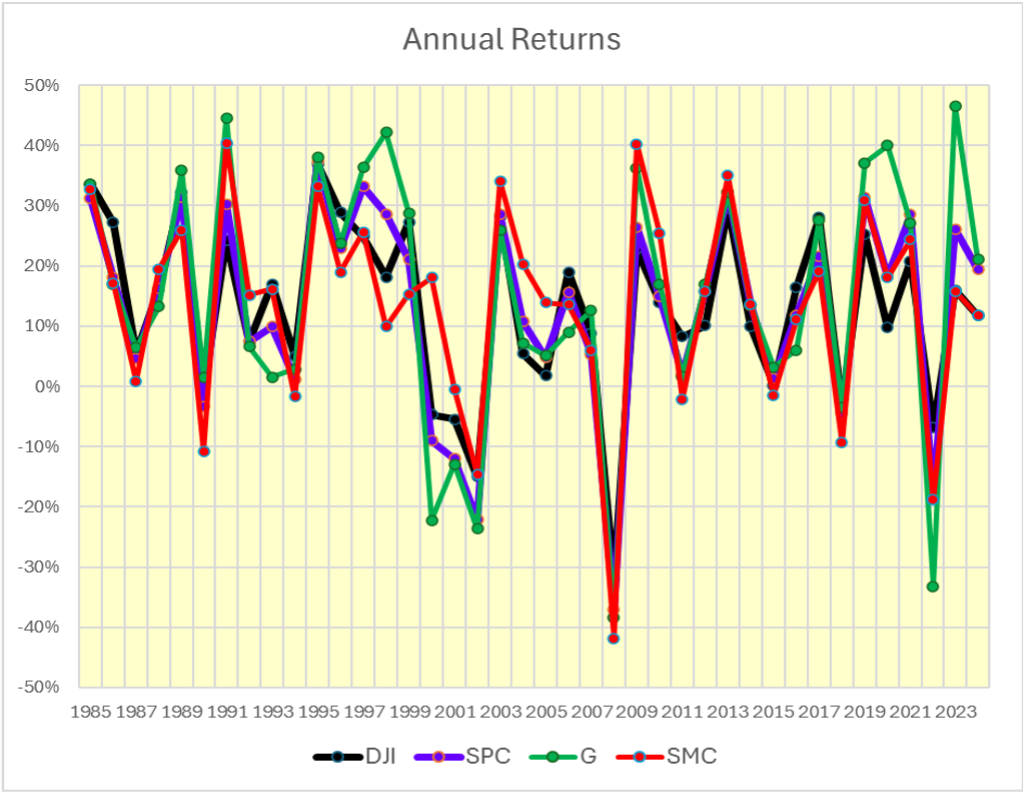

The last line of the table, labeled Multiple, is today’s value of a Dollar invested in each asset class in 1985. Growth leads the pack, followed by the Dow, Mid-Cap, and finally the S&P 500. The benefit is great, but the price to be paid in each instance is the downside years. This next chart shows those ups and downs.

There’s a reason I went through this exercise. Some clients haven’t preferred to re-optimize their allocation for several years. Yet, I’ve observed changes in optimization outputs over the past three years. Growth and the S&P 500 have performed better than in the past. As a result, those Asset Classes are showing up in optimizations for new clients. So, for tenured clients I wanted to determine an optimal mix for developing a more appropriate balance for the “Big 4” Asset Classes.

There’s a catch: re-optimizing a client who has been holding the Dow or Mid-Cap for a long period of time creates a tricky problem from an income tax perspective. When you have a position that has grown 24 to 27 times, you can’t casually sell a position without creating a large – taxable – realized capital gain. However, if these holdings are inside a Qualified Retirement Account, there’s no tax issue.

SOMETHING NEW

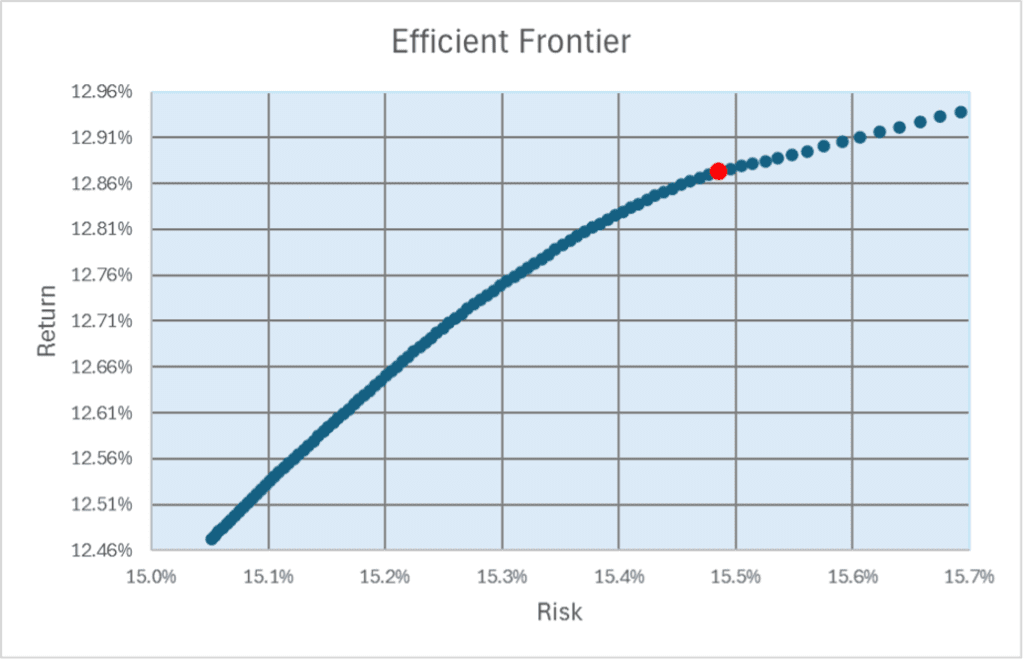

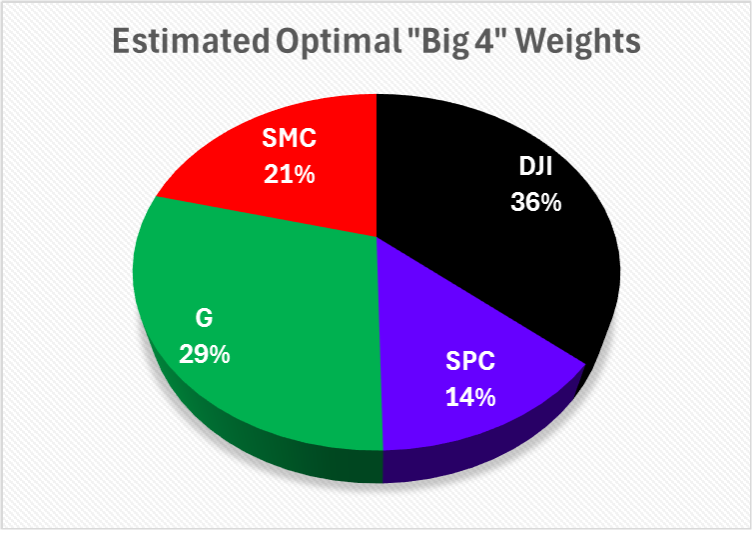

When I created a “portfolio” using just those four classes, here’s how the resulting options looked on an abbreviated Efficient Frontier. I say abbreviated because the range of returns was 0.5% and the range of risk was only 0.7%. The inflection point for the highest Risk/Return level is shown by the red dot on the curve. This isn’t a random dot; it is the point where you achieve the highest Risk-Adjusted Rate of Return on the curve. William F. Sharpe was also awarded the Nobel Prize in Economics in 1990 for his development of this measure in 1966. Using this measure yielded the point at which the portfolio allocation for the Big 4 that was optimal. This portfolio’s weights are shown in the chart below:

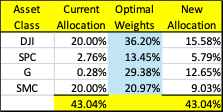

So, as we incorporate these weights into a client’s current “Big 4” (many are now 20% in two classes, or 50/50), we now have a rational way to utilize the newer trends that are a part of forty years of data. We will still have tax challenges, but this gives us a good way to keep you appropriately invested, whatever your preference for risk happens to be. The table below shows an example of how it works:

In this example, 43.04% is currently in the “Big 4,” mostly in two classes. Applying the weights, the new allocation is shown on the right. What I find fascinating is that those resemble the direction we’re seeing in optimized portfolios for clients who have recently come to us with similar risk preferences.

I’m excited about having a way to update long-held portfolios with a minimum of disruption and negative tax consequences. I’m more excited that this should lend itself to higher rates of return in the long run. Feel free to call if you have questions.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2024 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.