The Perversity of Statistics

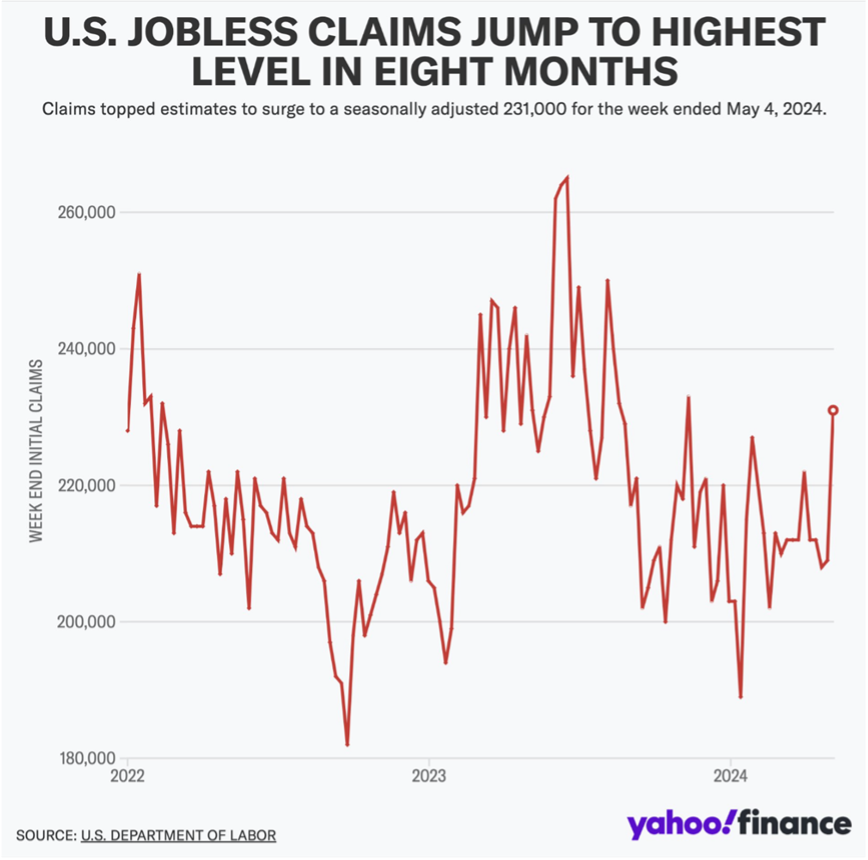

On May 9th it was announced that U.S. jobless claims unexpectedly rose to 231,000 over the last week. That’s the highest level since last August. You would think that’s terrible news – right? So why did the stock market jump up? Anything that might cause consumer spending to decline is viewed as highly positive by the equity markets.

Here’s the logic: If consumer spending declines = inflation starts to cool = the Fed lowers interest rates = the stock market goes crazy = we all live happily ever after (until the next manufactured crisis hits).

In the brief period since the end of the last quarter, we’ve seen the impact of unmet inflation expectations on financial markets. Last quarter ended with the S&P 500 at 5,254.35. By April 19th (when it was feared that the Fed would take no action) the S&P 500 dropped -5.5% to 4,967.23. Today it’s back up 5.06% to 5,218.45.

Here’s a scorecard for what to wish for if you want the markets to come roaring back:

- A decrease in GDP

- A decrease in Consumer Spending

- Unemployment Rises

- Wages Fall

- Mortgage Demand Falls

This reminds me of the saying, “Be careful what you wish for.”

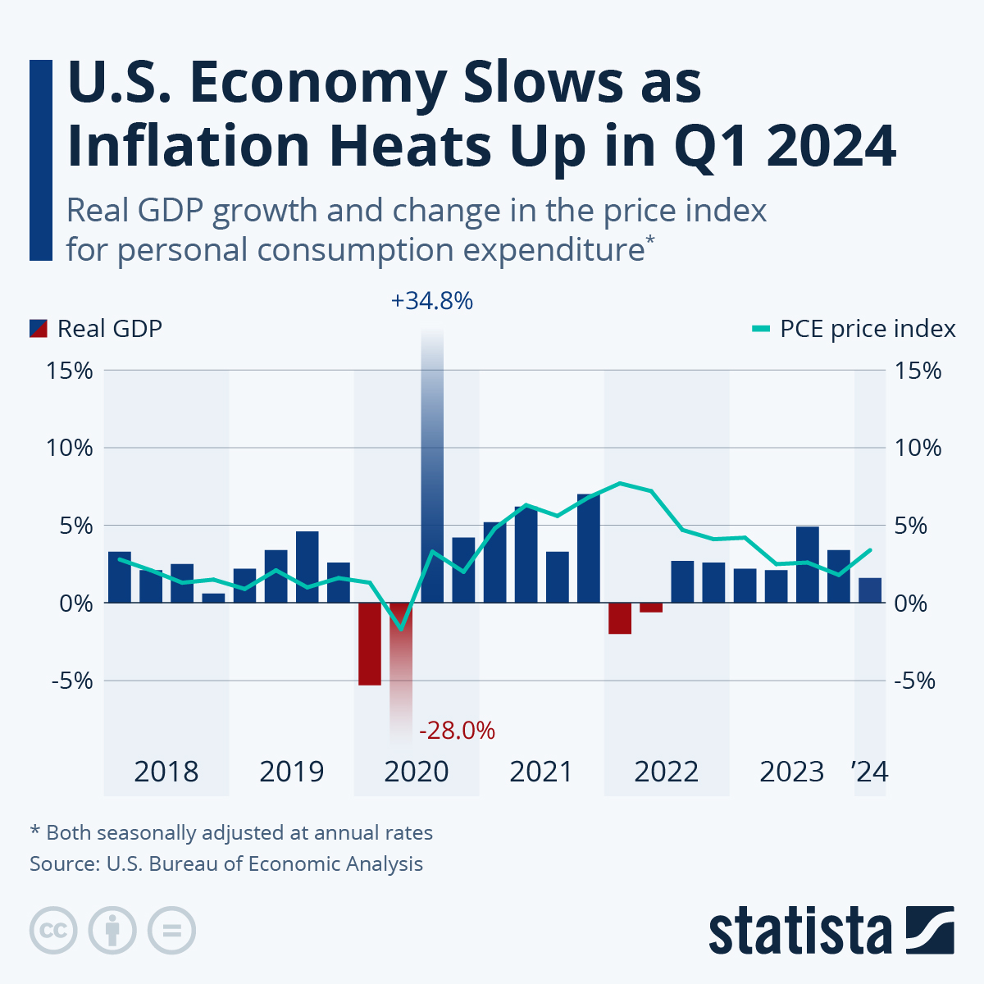

It’s also hard to know whether each of these factors are leading or lagging indicators. This next chart shows Consumer Spending versus Inflation. Going back to 2017 it’s hard to tell which came first, the chicken or the egg – Spending or Inflation. Most recently, inflation is presumed to cause spending slowdowns. Yet earlier in the chart, the opposite was true.

Worldwide, there are indicators that various economies are slowing. The EU may be the first to start lowering interest rates, followed by the UK. We are likely to be last to cut rates. It’s interesting that, behaviorally, we’re different from other areas of the world when it comes to spending money (that we don’t have). So, if you’re looking for a silver lining in the inflation story, pay attention to what the EU does strategically. At the moment, it is the best “economic indicator.”

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2024 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.