Retired

The Spangersons have grown uncomfortable with the complexity of the financial markets and are looking for professional help to ensure a consistent revenue stream.

*These fictitious scenarios are designed to generally illustrate how we may provide our services to a client. Keeping in mind that no two clients, situations, or experiences are exactly alike, these scenarios are not to be construed as an endorsement of the Firm by any of its past or current clients, nor any assurance that we may be able to help you achieve the same results.

Bob and Ruth Spangerson have been married for thirty-eight years and both retired two years ago. They have grown uncomfortable with their ability to manage their investments to produce a dependable income stream. Financial markets have posed real challenges in creating yield in their portfolio. Like many, they are concerned they may be doing more harm than good by simply using high-dividend stocks and watching the values decline and some of the dividends themselves get cut. They feel it is time to turn their portfolio over to a professional to manage their assets so that they can travel and enjoy life.

They are also concerned about how to pass on their estate to their two sons and one daughter and want to know how to help a charity in Honduras they’ve spent years serving.

Overview

Dr. Bob Spangerson

- Age 68

- Retired Anesthesiologist

Dr. Ruth Spangerson

- Age 68

- Retired General Surgeon

Family Finances

- Home at $778,000

- Home mortgage of $63,000, 3.5% w/ 5 years left

- Ruth’s Retirement Plan balance $3,657,000

- Bob’s Retirement Plan balance $2,704,000

- Joint Investment Account balance $2,308,000

Bob and Ruth’s Concerns

- How much they can afford to spend without stressing their portfolio and running out of money? They are guessing that they spend about $30,000 per month.

- How to invest to fund their monthly cash flow needs.

- How to update their estate plans, to ensure the outcomes are consistent with their values.

How We Suggest Helping the Drs. Spangerson

First, taking into account both Social Security income and portfolio income, we can see they could spend $36,328 per month if markets perform at historical levels. However, if markets perform more poorly, their portfolio could only sustain a withdrawal rate of $27,891 per month, a 23.2% reduction.

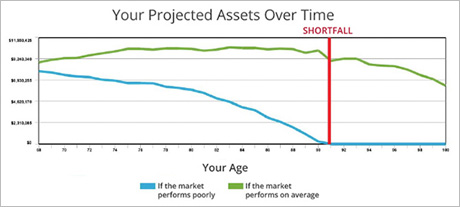

We would run the numbers and see if they spend at the $30,000 level, they would likely run out of funds at age 96. Because they were concerned that high income taxpayers might see a reduction in Social Security benefits, we re-ran our calculations without Social Security benefits. As the chart below demonstrates, were this to happen, and if poor market conditions persisted, they would likely run out of funds at age 91.

To offset this loss of income, they would need to spend at a monthly level of $24,258 (an additional reduction of 13.0%). In order to help them build clarity and ease into their expense monitoring process, we would probably refer the Spangersons to a CFP® Practitioner who specializes in helping clients establish cash flow infrastructures.

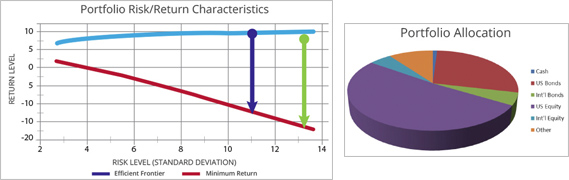

If we look at recent historical asset class data, their present portfolio has an expected return of 9.38% and had a potential downside return of -16.28%. We would suggest running an Individual Risk Profile for both Ruth and Bob as well as a joint profile for the two of them. Their combined profile indicated a loss willingness of no more than 12%. Their current portfolio characteristics are in green on this chart; their optimal portfolio is shown in navy. Their new allocation by broad categories is shown in the pie chart on the right.

With recent changes in Estate Tax Rates, the Spangersons should not have estate taxes due under their present Will/Trust structure. Yet their goal of supporting their charity in Honduras might be achieved without impairing their cash flow needs, their income tax situation or their ultimate estate wishes by utilizing a Charitable Remainder Trust. With about $2,400,000 of their portfolio situated in Bonds, a portion of these could be shifted into an Annuity Trust form of CRT and a fixed rate paid out each year.

*These fictitious scenarios are designed to generally illustrate how we may provide our services to a client. Keeping in mind that no two clients, situations, or experiences are exactly alike, these scenarios are not to be construed as an endorsement of the Firm by any of its past or current clients, nor any assurance that we may be able to help you achieve the same results.

Hypothetical client

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.